Ministers' demands for banks to show restraint in this year's bonus round look set to be defied by taxpayer-backed Lloyds with a £2 million award for its chief executive.

Eric Daniels, who is to leave the bank in March, is reported to be in line for the windfall after waiving any bonus for the past two years.

Cabinet minister Philip Hammond said the award, which follows claims that the Government has backed down in its battle with the banks, was "not welcome news".

Mr Daniels is entitled to a £2.3 million maximum bonus, set at 225% of salary, but any payout of that order will fuel anger over bank handouts.

Downing Street described the £2 million figure reported by the BBC as "speculation" and said the Treasury had not been informed about bonus proposals by Lloyds.

Lloyds, which declined to comment on Mr Daniels' bonus, is 41% owned by the taxpayer after it was bailed out during the financial crisis, when it lost billions.

The bank clawed its way back into profit in 2010 with a £1.6 billion surplus at the half-year stage, but Mr Daniels also presided over its ill-fated deal to buy Halifax Bank of Scotland at the height of the meltdown.

The Government is under pressure to enforce restraint on lavish banker bonuses this year - particularly within partially state-owned Lloyds and Royal Bank of Scotland.

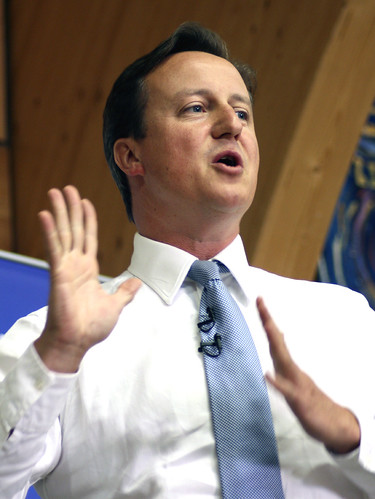

David Cameron told MPs at Prime Minister's Questions that the Government wanted a settlement with banks where "their taxes go up, their lending goes up and their bonuses come down".

But Labour leader Ed Miliband accused him of failing to deliver on a pre-election promise to restrict bonuses in largely state-owned banks to £2,000 or implement legislation forcing financial institutions to declare any bonuses over £1 million.

Copyright (c) Press Association Ltd. 2010, All Rights Reserved.