Copper prices reached their highest level in over five weeks but experienced a pullback as inventories on the London Metal Exchange (LME) increased, signaling an improving supply situation.

The price of three-month copper on the LME touched $8,634 per metric ton, the highest since May 10, before settling at $8,565 per metric ton, up 0.1%.

The rise in copper inventories in LME warehouses, with over 16,350 tonnes added, contributed to a 14% increase in total stocks. According to Dan Smith, head of research at Amalgamated Metal Trading, as prices rise, surplus metals tend to be flushed out of the system, resulting in unexpected metal supplies in various locations.

Liberum's note indicates that copper is projected to have a global market surplus of 240,000 metric tons this year after experiencing a deficit of 180,000 tonnes in 2022. LME copper has rebounded by almost 10% since hitting a six-month low on May 24 and has recorded a 2.3% increase so far this week, marking its third consecutive weekly gain.

While Smith remains optimistic about copper, he finds it challenging to justify the recent rally in other base metals, attributing it largely to speculators. Despite high interest rates and weak manufacturing demand, metal flooding onto the exchanges has not been observed to the extent expected.

The market is also supported by growing expectations of additional measures from China to strengthen its post-pandemic recovery following disappointing economic data. The most-traded July copper contract on the Shanghai Futures Exchange closed 1% higher at 68,630 yuan ($9,634.04) per metric ton.

However, actual copper consumption in China remains subdued. A Chinese copper rod producer noted that higher prices have limited their willingness to purchase copper, given the sluggish demand during the traditional off-peak season.

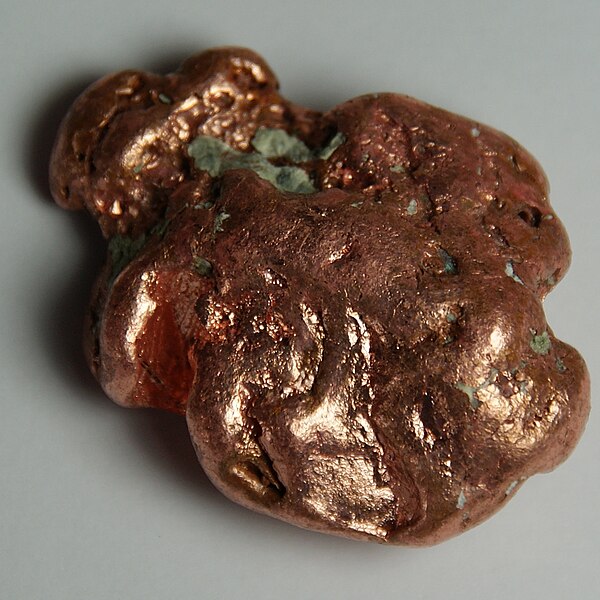

In other metal markets, LME aluminum gained 1% to $2,272.50 per metric ton, nickel added 0.2% to $23,045, tin rose 0.9% to $27,470, zinc climbed 0.7% to $2,496.50, and lead increased by 0.4% to $2,138.50. Photo by Jurii, Wikimedia commons.