Revolut, the fast-growing fintech firm, is reportedly set to secure its UK banking licence within the next few weeks, according to The Mail on Sunday. The digital bank is expected to clear a

significant hurdle towards gaining formal recognition from regulators this week when it releases its financial accounts for 2021, which are due to mark its first full-year profits. The release is set to be signed off by auditor BDO. Securing a banking licence from the country’s foremost financial watchdogs, the Prudential Regulation Authority and the Financial Conduct Authority, would allow Revolut to lend money and offer more traditional banking services, which has become increasingly attractive due to interest rates hitting their highest level in 15 years at four percent.

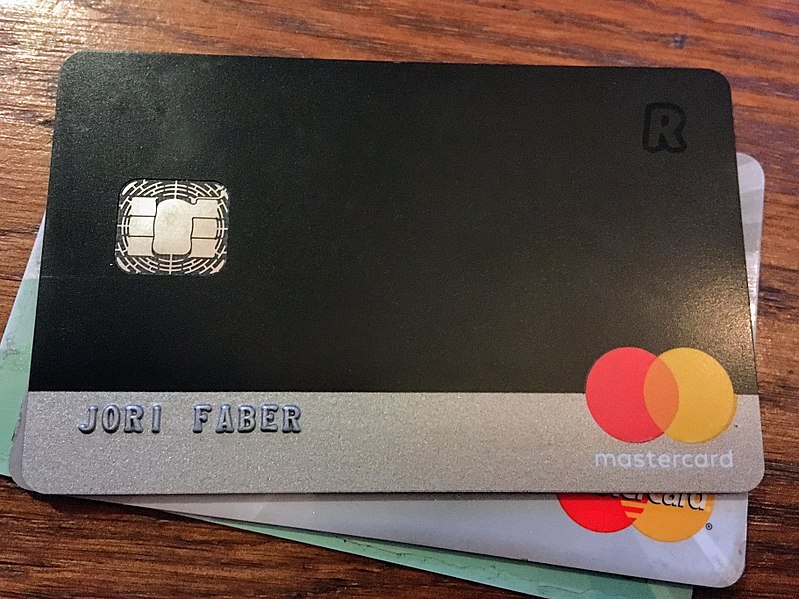

Revolut, which is valued at nearly £30bn, has ridden the wave of consumers shunning physical cash and opting for mobile-based banking, offering a wide range of typical banking services, having initially started out by offering currency exchange cards. The company’s CEO, Nik Storonsky, 38, has campaigned long and hard for recognition that Revolut is operating in line with legal requirements and consumer protections, and gaining the licence would mark a significant achievement for the company. Revolut has already succeeded in securing banking licences in several western European markets. Monzo, Revolut's competitor, has held a banking licence for several years, as has Starling.

Revolut's announcement to hire around 1,700 people in London over the next year is set to be supercharged if it secures the highly coveted UK banking licence. While Revolut declined to comment on its ongoing licence application, gaining the licence would mark a major step towards offering more traditional banking services and unlocking new opportunities for growth. Photo by JFD~nlwiki, Wikimedia commons.